life insurance face amount decrease

To protect your loved. Instead of canceling your policy or spending money on 1 million in term life.

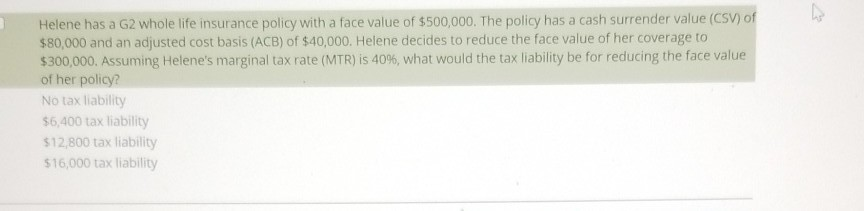

Solved Helene Has A G2 Whole Life Insurance Policy With A Chegg Com

This is the dollar amount that the policy owners beneficiaries will receive upon the.

. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. Level Death Benefit Beneficiaries will only get the face amount as per the initial insurance contract. Average life insurance face amounts have come down from a high point of 175000 in the mid 2000s.

Life Insurance Face Amount - If you are looking for the best life insurance quotes then look no further than our convenient service. The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. For example if you buy a 100000 life.

Increasing Death Benefit-It is another kind of exciting. Its the amount of death benefit purchased which indicates the amount of. If you decide for example to leave your loved ones with 200000 you apply for life.

The face value or face amount of a life insurance policy is established when the policy is issued. Can I reduce the face amount of my term life insurance. For issue age 65 and older.

Face amount life insurance definition industrial life. The policy is convertible until the earlier of the end of the initial term period or the policy anniversary at the insureds attained age 70. If your insurer finds out about any misinformation you provided they can reduce the face amount of your policy or not pay out any money whatsoever.

A permanent life insurance policy has a face value also known as the death benefit. Most insurance companies will allow you to modify your life insurance policy whether to increase or. Group Variable Universal Life Insurance Face Amount Decrease Request Form 1 Instructions Please print using blue or black ink.

Normally the face amount is a round number like. For instance if you are young lets say under 30 years old some life insurers might allow you to have a life insurance policy with a face amount that is equal to 40 times your annual income. Use this form to request a decrease in the Face Amount of.

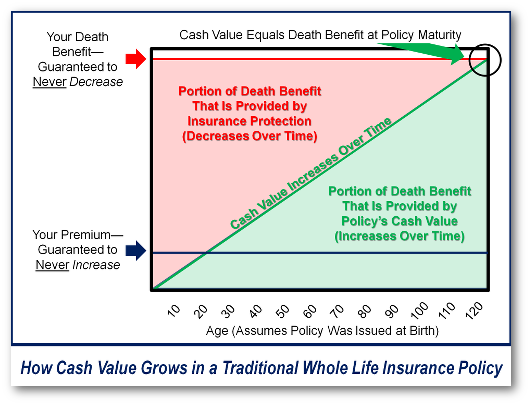

Loans Conversely the face value can decrease if you take out a loan on your permanent insurance policy because you are tapping into the cash value of the policy. The face amount of a policy is the amount you request when you apply for life insurance. If your policy has the following features it could decrease the.

In that case you will probably find the term life policy youve might be more than youll need.

5 Quickest Ways To Lower Your Life Insurance Premium Aakash Garg

Life Insurance In Depth Custom Wealth Management

What Happens If You Fail To Pay Life Insurance Premiums

Solved Bethany Has A G2 Whole Life Insurance Policy With A Face Value Of Course Hero

Term Life Insurance Products The Annuity Expert

What Is The Face Amount Of Life Insurance And Why It Matters

What Is The Life Insurance Face Amount Nerdwallet

What Is The Face Value Of Life Insurance Bankrate

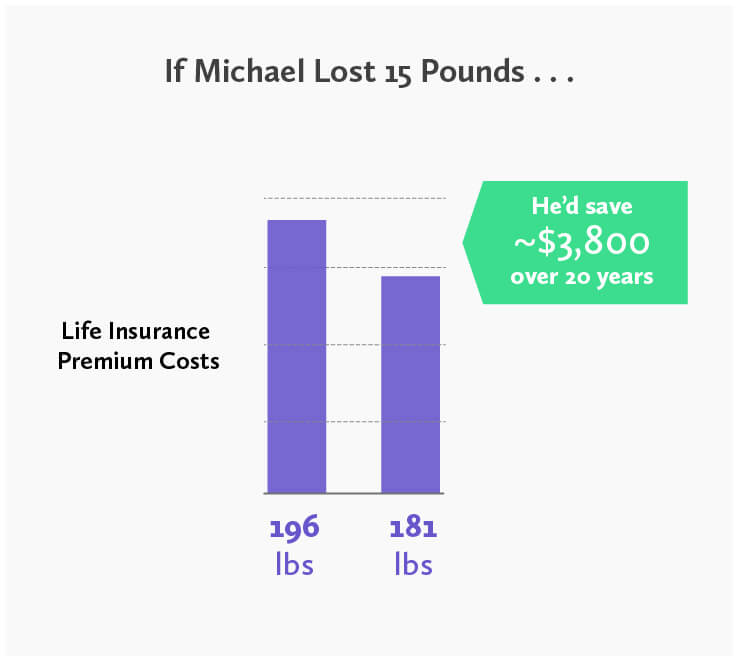

Over 3 000 Losing Weight Could Save You On Life Insurance

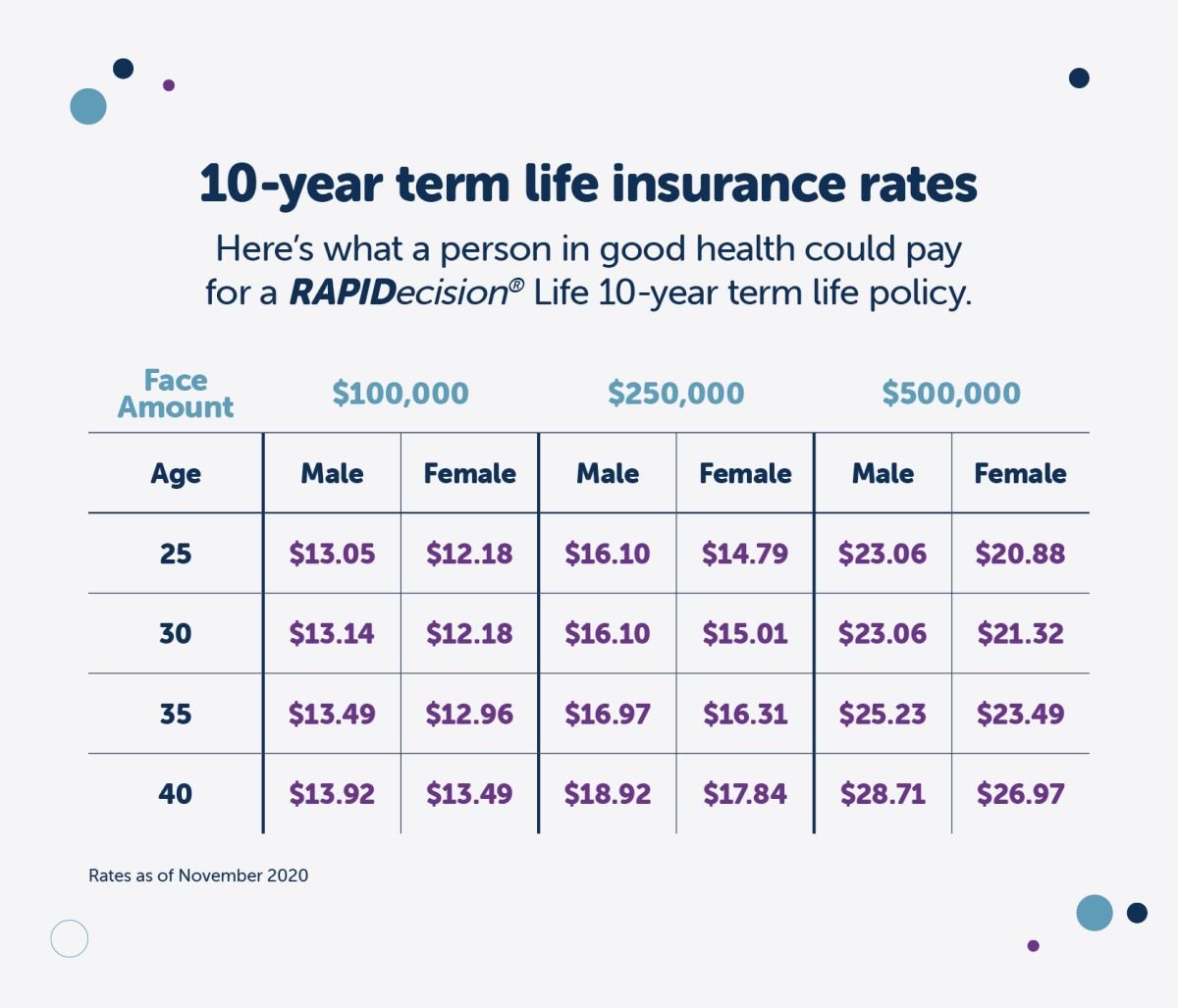

How Much Does Life Insurance Cost

Index Indexed Universal Novel Insurance And Wealth Management

How To Read And Understand Your Whole Life Insurance Statement The Insurance Pro Blog

How Much Is Life Insurance Average Costs Progressive

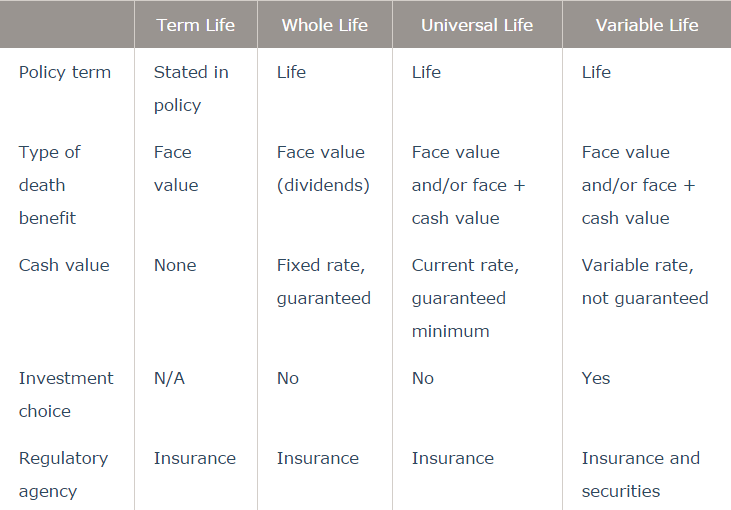

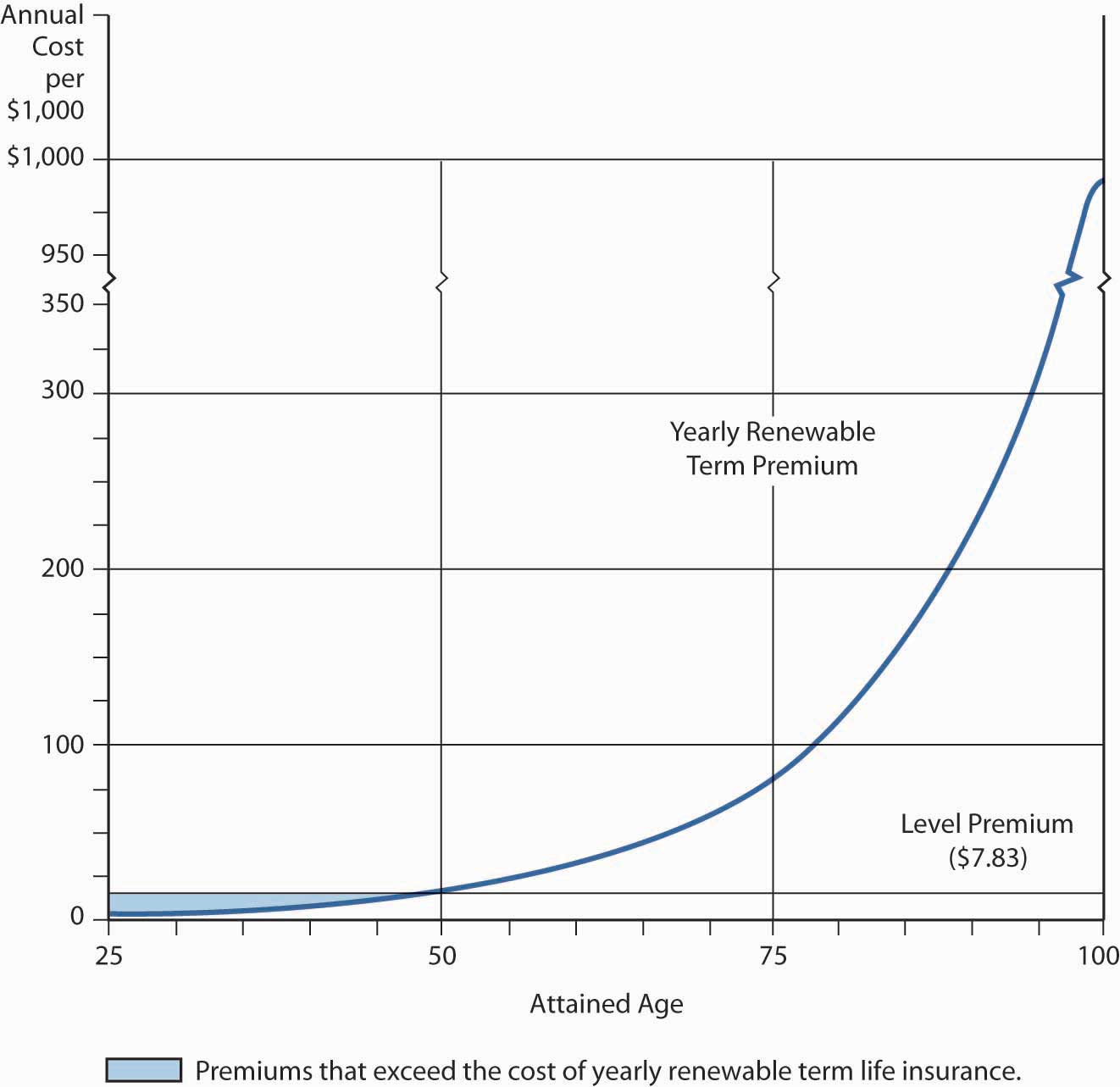

7 1 Adjustable Life What Is It Flexible Premium Adjustable Death Benefit Type Of Permanent Cash Value Insurance Hybrid Combination Of Universal Ppt Download